As the name suggests, DSCR loans are underwritten based on a property’s DSCR — the ratio of rental income to debt obligations like mortgage payments, taxes, and insurance. Unlike traditional banks, DSCR lenders don't factor in your personal income, debt-to-income ratio, or employment history.

You can calculate a property’s DSCR by dividing income by expenses. For instance, if an 8-unit multifamily home generates $20,000 in rental income and has $16,000 in debt payments, taxes, and insurance, its DSCR is 1.25 (20,000 ÷ 16,000).

The minimum DSCR a property must meet to qualify varies from lender to lender, but we’ve funded properties with a DSCR as low as 0.75.

DSCR loans offer key advantages to borrowers purchasing multifamily homes:

- You qualify based on the property’s cash flow. Lenders don’t evaluate your financials, so you won’t need to submit W-2s, tax returns, debt-to-income paperwork, or pay stubs. This makes DSCR loans ideal for real estate investors with non-W-2 income, high debt-to-income, heavy write-offs, or complex finances who want to grow their portfolio. They aren’t limited by personal income or loan caps.

- You can close faster than with traditional bank loans. With less paperwork and underwriting, DSCR lenders generally close quickly. For example, we’ve funded multifamily properties in as little as four days while banks typically take 30+ days.

This article outlines the requirements to qualify for a DSCR multifamily loan, how to apply, and the paperwork you’ll need. It also explains how to compare lenders to secure low-interest rates, close fast, and beat cash buyers for the best deals.

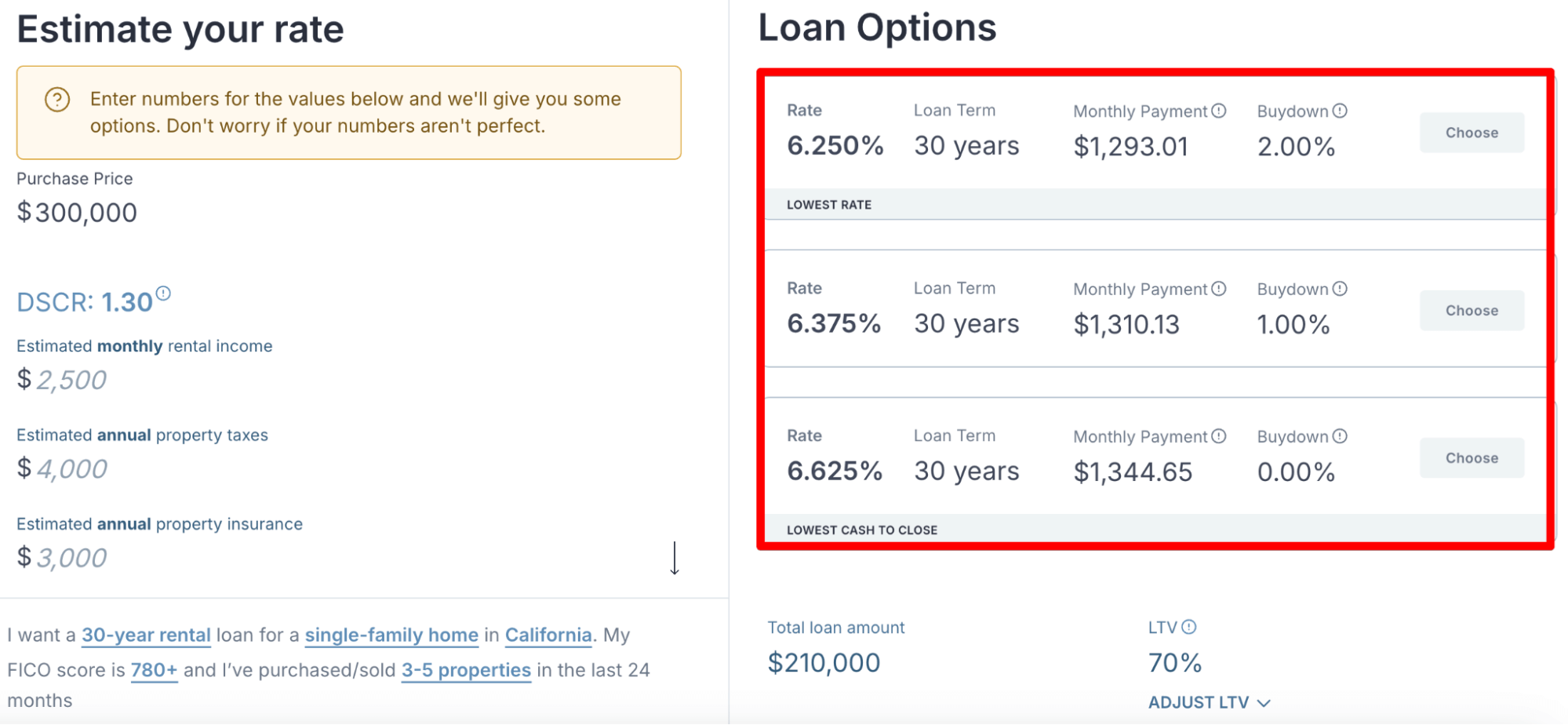

Use our automated DSCR loan pricer to pull an instant quote and see what terms you qualify for.

Requirements for Securing DSCR Multifamily Loans

Most DSCR lenders have three main requirements:

- Minimum DSCR, typically 0.75 to 1.00 or higher

- Down payment of 20–30%

- Credit score of at least 660

Minimum DSCR of 0.75

To estimate DSCR (debt-service coverage ratio), lenders typically consider rental income from past tenants and comparable properties in the area, then divide that number by projected mortgage payments, taxes, and insurance.

Most lenders prefer a DSCR of 1.0 or higher, which shows the property’s rental income can fully cover expenses and absorb periods of vacancy without the owner paying out of pocket.

That said, some lenders will fund deals with a DSCR below 1.0. For example, Constitution Lending can fund deals with a DSCR as low as 0.75 — meaning rent only needs to cover 75% of the property’s expenses.

Down Payment of 20% to 30%

Most DSCR lenders finance 70–80% of a property’s purchase price, requiring borrowers to put down 20–30%. This equity keeps investors committed to the property’s performance.

For cash-out refinancing of a multifamily investment with a DSCR loan, lenders will typically be willing to lend a maximum of 65% to 75% of the property value.

Credit Score of 660 or More

While DSCR lenders primarily evaluate an investment property’s net operating income (NOI), they still want to see that the borrower has a history of paying their debts on time. That’s why minimum credit requirements matter.

A stronger credit score not only helps you qualify but also unlocks lower interest rates and more flexible terms.

Most DSCR lenders require a minimum credit score of 700. However, with Constitution Lending, borrowers only need a credit score of 660.

When you apply for a multi-family loan with a large bank, you’ll typically need:

- Near-perfect credit (usually 720 or higher)

- Extensive personal income documentation (W-2s, tax returns, pay stubs)

- A low debt-to-income ratio, typically under 35% of your annual personal income

- Significant cash reserves showing you can make debt payments even when the investment property is vacant

- A strong track record in real estate investing or as an apartment building owner

How to Apply for a DSCR Multifamily Loan

Each lender has different application processes and paperwork requirements. We can’t speak for all of them, so we’ll outline this section according to our process:

1. Enter property details into our loan pricer to see if you qualify. Our pricer will give you three instant quotes, specifying the loan amount you qualify for, the interest rates, loan duration, fees, and buydowns.

2. If you like one of our offers, simply click on it, enter your full name, phone number, and email address. From there, you can download a quote, pre-approval letter, and a term sheet.

3. Within a few minutes, we’ll send you an email link to our client portal, where you can see what documents are required and submit them. Our portal will ask for bank statements, entity documents, proof of insurance, and construction budget (if relevant).

4. Once you submit the required documents, we begin underwriting and close within 7 to 14 days. In urgent situations where borrowers were competing against a quick cash buyer and needed to close faster, we’ve closed in 4 days.

Compare our process — where you can generate quotes, term sheets, and pre-approval letters in just minutes — to banks, which make you book a consultation, visit a branch, explain your situation, and then wait weeks for the same documents.

On top of that, banks drag out underwriting for weeks, so you won’t close for 30+ days. That makes them a poor fit if you need to close fast.

How to Compare DSCR Financing Providers

Consider How Quickly They Can Close

The most important factor in choosing a lender is closing speed. It often determines whether you can beat cash buyers to discounted deals.

The challenge is that most DSCR lenders claim they can close in just a few days. In reality, they usually drag out the process. We’ve had countless borrowers tell us they partnered with “fast” lenders, only to lose profitable deals when funding was delayed.

In our experience, you can gauge a lender’s closing speed by how quickly they deliver term sheets. If they’re slow at this, their internal processes are likely slow too — and that delay will carry through to closing.

With Constitution Lending, our automated pricer and documents portal allows us to fund your commercial property purchase much faster than most lenders.

Simply enter a few details into our DSCR calculator to instantly see your interest rate, term, and buydowns. From there, you can download a term sheet and pre-approval letter, upload your documents, and close within just a few days.

Consider Whether They Are a Direct Lender or Loan Broker

A common problem we hear from borrowers is being told they qualify — only to have their application rejected at closing.

This happens most often with loan brokers. When you apply through a broker, you’re not dealing directly with the lender, but with a middleman connecting you to them. That creates several issues:

- Brokers don’t fund loans, so they aren’t the final decision-makers.

- They can review your documents and make an educated guess, but they can’t guarantee approval.

- To confirm eligibility, they must submit your application to the lender, wait for underwriting (which can take weeks), and only then provide a final answer.

- If the lender spots a problem late in the process, you can face last-minute rejections — even after being told you qualify.

That’s why it’s smarter to work with a direct lender like Constitution Lending for your DSCR multifamily loan.

We fund the loan ourselves and make the final eligibility decision. Having funded thousands of real estate loans, we know exactly what borrowers need to qualify and can give you a definitive answer as soon as you submit your documents. The result? More upfront communication and far fewer last-minute surprises.

FAQs

Can you get a DSCR loan on a multifamily property?

Yes. DSCR loans can be used to purchase or refinance multifamily apartments, including 2–4 unit properties and even 5–8 unit apartment buildings.

For many investors, this is the most practical financing option because lenders focus on the property’s debt-service coverage ratio (its cash flow versus its debt obligations) rather than the borrower’s personal profile.

That means you don’t need to provide income verification, tax returns, employment history, or worry about a high debt-to-income ratio.

How much is a down payment on a DSCR multifamily loan?

Most DSCR lenders finance 70% to 80% of a property’s purchase price, which means borrowers need a down payment of 20% to 30% to qualify. Naturally, the more you can put down, the better interest rates and loan terms you’ll typically receive.

What is a good DSCR for multifamily?

Most DSCR lenders look for a DSCR of 1.0 or higher, since this shows the property can cover its mortgage payments and expenses with its rental income — without the borrower having to subsidize expenses with their salary or cash reserves. That said, with today’s higher interest rates, we’ve approved properties with a DSCR as low as 0.75.

What are the benefits of a DSCR loan?

The biggest advantage of a DSCR loan is that it’s underwritten based on the property’s income versus expenses — not your personal financial profile. That means you don’t have to worry about submitting income verification, W-2s, employment history, or any other financial paperwork.

This makes DSCR loans popular among self-employed real estate investors, borrowers with complex finances, or those carrying a high debt-to-income ratio.

What are the eligibility requirements for a DSCR multifamily loan?

The three main requirements for multifamily DSCR loans are a minimum DSCR, a down payment, and a solid credit score. Most lenders expect a DSCR of at least 1.0 (meaning the commercial real estate’s income covers its expenses), a down payment of 20–30%, and a credit score of 660 or higher.